Insurance Brokers Association of Canada VENDOR JOINT MARKETING APPLIED SYSTEMS

January 2023 In Canada, the Property & Casualty (P&C) insurance industry lags other industries on connectivity within the broker channel. As a result, brokers struggle with process friction and duplication of effort (double entry), resulting in unnecessary expense and a less than ideal client experience. Brokers use their own systems to manage their clients and […]

Insurance Brokers Association of Canada VENDOR JOINT MARKETING DELTEK

January 2023 In Canada, the Property & Casualty (P&C) insurance industry lags other industries on connectivity within the broker channel. As a result, brokers struggle with process friction and duplication of effort (double entry), resulting in unnecessary expense and a less than ideal client experience. Brokers use their own systems to manage their clients and […]

Insurance Brokers Association of Canada IBAC DXCA API BENEFITS WHITEPAPER

January 2023 Executive Summary The broker channel of the P & C insurance industry lags other sectors on connectivity. As a result, the channel struggles with process friction & duplication of effort (double entry), resulting in unnecessary expense and a sub-optimal client experience. IBAC aims to encourage connectivity investment by carriers & broker vendors, as […]

Insurance Brokers Association of Canada VENDOR JOINT MARKETING BROKERLIFT

January 2023 In Canada, the Property & Casualty (P&C) insurance industry lags other industries on connectivity within the broker channel. As a result, brokers struggle with process friction and duplication of effort (double entry), resulting in unnecessary expense and a less than ideal client experience. Brokers use their own systems to manage their clients and […]

Insurance Brokers Association of Canada VENDOR JOINT MARKETING CSSI

January 2023 In Canada, the Property & Casualty (P&C) insurance industry lags other industries on connectivity within the broker channel. As a result, brokers struggle with process friction and duplication of effort (double entry), resulting in unnecessary expense and a less than ideal client experience. Brokers use their own systems to manage their clients and […]

Insurance Brokers Association of Canada VENDOR JOINT MARKETING BROKERCORE

JANUARY 2023 In Canada, the Property & Casualty (P&C) insurance industry lags other industries on connectivity within the broker channel. As a result, brokers struggle with process friction and duplication of effort (double entry), resulting in unnecessary expense and a less than ideal client experience. Brokers use their own systems to manage their clients and […]

Insurance Brokers Association of Canada VENDOR JOINT MARKETING NUDE

January 2023 In Canada, the Property & Casualty (P&C) insurance industry lags other industries on connectivity within the broker channel. As a result, brokers struggle with process friction and duplication of effort (double entry), resulting in unnecessary expense and a less than ideal client experience. Brokers use their own systems to manage their clients and […]

Insurance Brokers Association of Canada VENDOR JOINT MARKETING PATHWAY

January 2023 In Canada, the Property & Casualty (P&C) insurance industry lags other industries on connectivity within the broker channel. As a result, brokers struggle with process friction and duplication of effort (double entry), resulting in unnecessary expense and a less than ideal client experience. Brokers use their own systems to manage their clients and […]

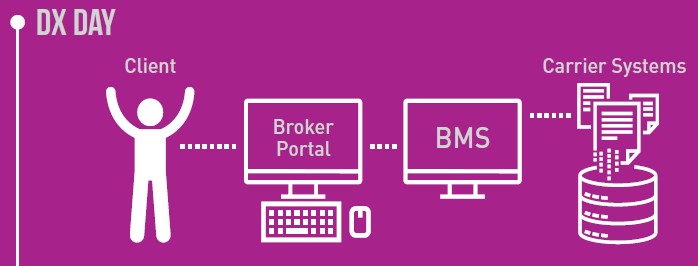

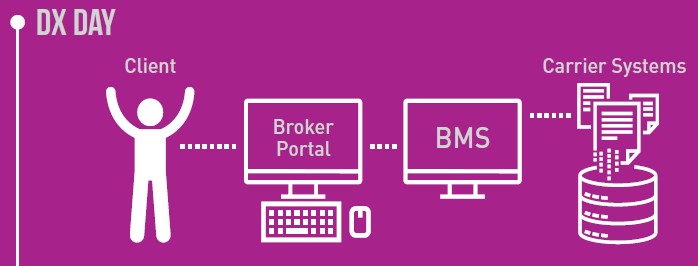

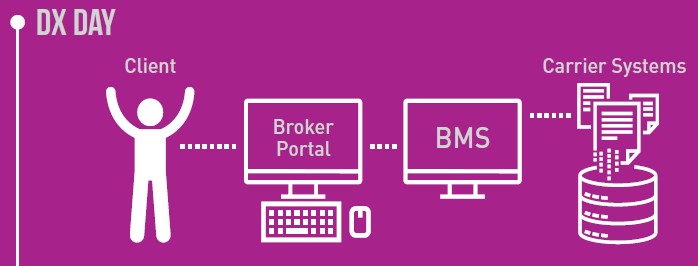

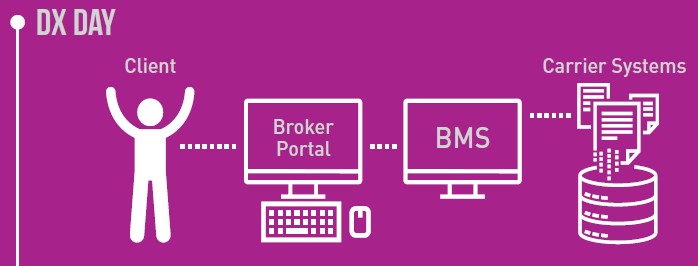

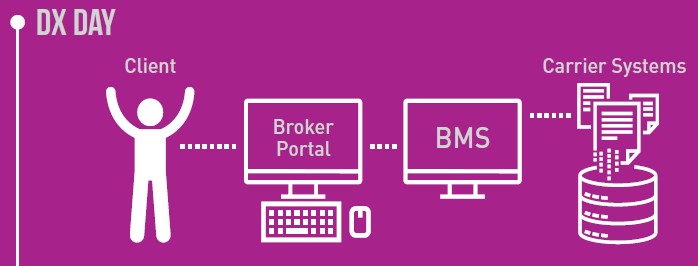

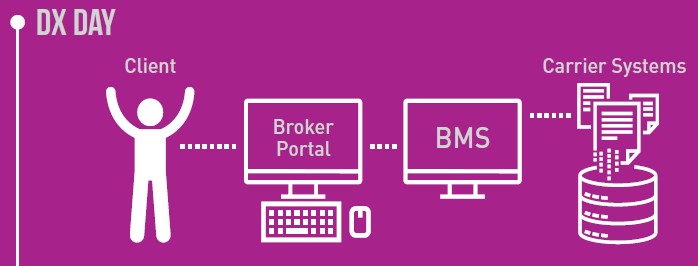

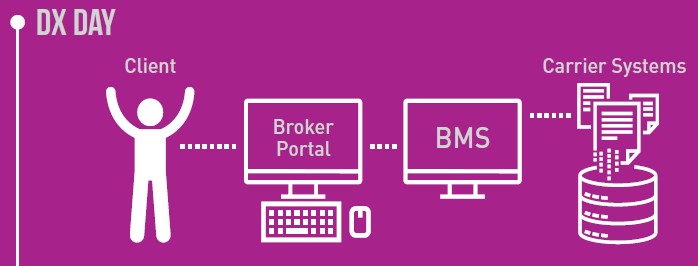

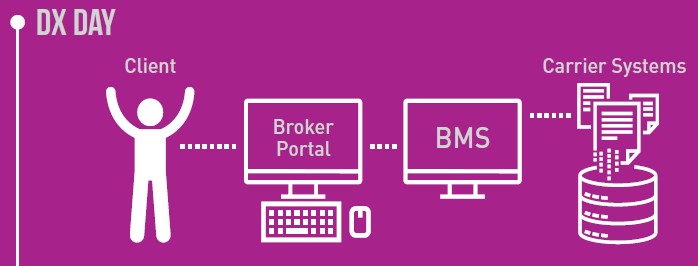

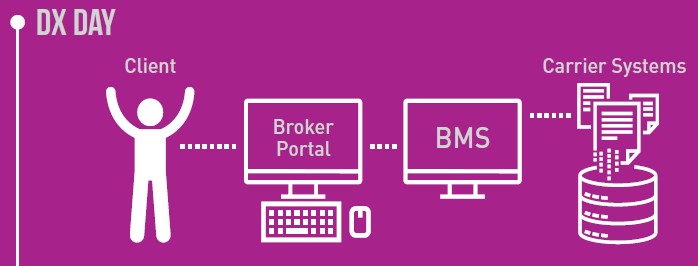

Insurance Brokers Association of Canada DATA EXCHANGE

JUNE 2021 IBAC DX “Imagine a day when your client asks you a question about their existing claim and instead of needing to send an email or make a call to the adjustor you would have the answer at your fingertips – inside your BMS” OVERVIEW What is DX? Why should brokers care? What is […]