January 2023

In Canada, the Property & Casualty (P&C) insurance industry lags other industries on connectivity within the broker channel. As a result, brokers struggle with process friction and duplication of effort (double entry), resulting in unnecessary expense and a less than ideal client experience.

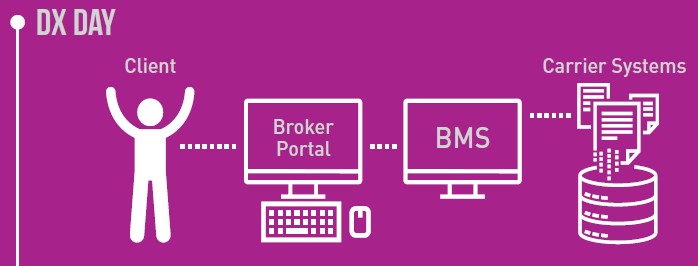

Brokers use their own systems to manage their clients and carriers use theirs. Initial data entry is done by the broker into their BMS and then re-keyed (by the broker) into the carrier portal.

This approach requires double entry by the broker and introduces delays and data quality issues, which in turn require manual intervention and negatively impacts the end client experience.

While most other industries have made great headway in real-time data sharing and transmission along the steps in the value chain, real-time data connectivity remains in its infancy in the P&C industry.

However, there is progress being made. Pathway has recently introduced some exciting new features, including:

- Automated Quote Generation

- Pathway & Optiom have rolled out a quote generation tool that allows brokers to automatically generate a quote on supplemental vehicle insurance for their

existing clients. This allows brokers to upsell target clients with accurate pricing, without the need for manual intervention and takes advantage of Pathway’s

automated email follow up process.

- Pathway & Optiom have rolled out a quote generation tool that allows brokers to automatically generate a quote on supplemental vehicle insurance for their

- Self-Serve Kiosk

- The self-serve kiosk seamlessly integrates with your BMS to allow clients to automatically generate a digital proof of insurance and policy summaries. The kiosk updates behind the scenes every 24 hours to keep the client information up to date. This convenient digital app empowers policyholders to get the information they want when they need it, reducing broker workload on non revenue generating requests.

- Automatic Trigger System

- This intuitive functionality helps deliver the right message to the right prospect or policyholder at the right time. The trigger system integrates with your BMS to automatically send relevant messages to your clients, including policy touchpoints as well as value added information, such as weather alerts. The automatic trigger system is part of Pathway’s Marketing Bot tool and allows brokers to perform important sales steps with reduced effort.

The enhancements above allow Pathway brokers to drive incremental sales volume with less manual touchpoints and an enhanced digital experience for the client. The full technical integration is assisted by the Pathway team, ensuring easy initiation of these powerful features.

Real-time connectivity will not arrive in the broker channel all at once – the progress will be incremental. We encourage brokers to discover the enhancements that their vendor partners have already implemented and to make use of them.

We also encourage carriers and vendors to continue to make investments in real-time connectivity. Given that there are benefits to customers, brokers, and carriers, it only makes sense to push this as hard and fast as possible.