JANUARY 2023

In Canada, the Property & Casualty (P&C) insurance industry lags other industries on connectivity within the broker channel. As a result, brokers struggle with process friction and duplication of effort (double entry), resulting in unnecessary expense and a less than ideal client experience.

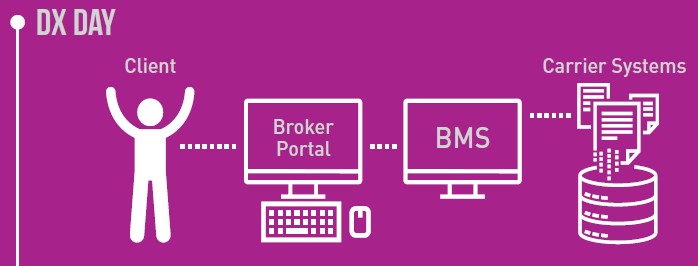

Brokers use their own systems to manage their clients and carriers use theirs. Initial data entry is done by the broker into their BMS and then re-keyed (by the broker) into the carrier portal.

This approach requires double entry by the broker and introduces delays and data quality issues, which in turn require manual intervention and negatively impacts the end client experience.

While most other industries have made great headway in real-time data sharing and transmission along the steps in the value chain, real-time data connectivity remains in its infancy in the P&C industry.

However, there is progress being made. Brokercore has recently introduced some exciting new features, including:

- Agnostic Rating

- Brokercore was an early adopter & invested in using the standards developed with the CSIO Commercial Lines project. As an interim / transition step, Brokercore has embarked on a solution that allows brokers to connect and provide rating through alternative means, while preserving the ability to migrate standardized APIs when available. These alternatives include manufactured rates, drag & drop Excel raters, and sophisticated plugin offerings. These allow traditional and delegated authority brokers the ability to embrace technology now, and easily transition to full APIs when available.

- Non-Rating API Connectivity

- APIs have become more prevalent outside of rating, Brokercore has applied this technique in other ways, including the ability to lookup real-time data from 3rd parties. Real time validated data reduces effort, improves data accuracy, and reduces E&O.

- SSO & Data Payloads

- Sometimes connectivity through APIs isn’t the answer, or the technology is too difficult to implement today. Brokercore has implemented the ability to for sizable amounts of client data to be sent, or received, via the click of a button. Using Single Sign-On style tokens, we allow trusted users to be automatically authenticated while passing a payload of data to pre-populate a form, start a workflow or any number of other tasks. This alternative approach to connectivity minimizes double data entry and improves data accuracy.

Real-time connectivity will not arrive in the broker channel all at once – the progress will be incremental. We encourage brokers to discover the enhancements that their vendor partners have already implemented and to make use of them.

We also encourage carriers and vendors to continue to make investments in real-time connectivity. Given that there are benefits to customers, brokers, and carriers, it only makes sense to push this as hard and fast as possible.