Information in the event of a data breach

No business owner would want to experience a data breach that exposes customer data, or suffer the reputational harm that would bring. Protecting client data and the IT Systems your business depends on should be a top of mind priority for every business. Canada’s data privacy and data protection laws continue to evolve, with mandatory […]

DISASTER PLANNING RESOURCES

YOU NEED A PLAN. Disasters, whether natural or otherwise can hit any time and without notice. The best line of defense is offense—prepare your employees, physical office, data, systems and clients with procedures to implement when disaster strikes. Be prepared to serve without power, phone, Internet and even without a physical office location. Agency principals […]

Agency Universe Study 2020 – ACT Technology Results Summary

Future One is a cooperative effort of the Independent Insurance Agents & Brokers of America (IIABA) and independent agency companies. It sponsors a variety of programs to enhance the independent agency system and agency-carrier relationships, both legislatively and in the business environment. One of Future One’s major efforts has been the Agency Universe Study (AUS), […]

Organic SEO Is Evolving—and So Should Your Strategy

Organic SEO Is Evolving—and So Should Your Strategy In March 2025, SEO software giant Ahrefs analyzed over 300,000 keywords. They uncovered a troubling trend—when Google’s AI Overviews appear in search results, the click-through rate (CTR) for the top organic result drops by a staggering 34.5%. That’s not a slight dip. It’s a shift in […]

Case Study: Avanta Insurance Brokers

Case Study: Avanta Insurance Brokers satisfied with Stage2Data’s Cloud Hosting and Managed Backup Service Download The PDF version

Case Study: ANGUS-MILLER LTD.

5ngusfMiller Ltd1 is a full service MG5 with product offerings including Personal Linsey Commercial Property Commercial liability Commercial 5utoy Professional Liability Surety TIC Travel Insurance Boiler and Machinery as well as unique HolefinfOne insurance1 Download The PDF version

Case Study: Park Georgia Insurance Agencies

Case Study: Park Georgia Insurance Agencies Download The PDF version

Insurance Brokers Association of Canada VENDOR JOINT MARKETING APPLIED SYSTEMS

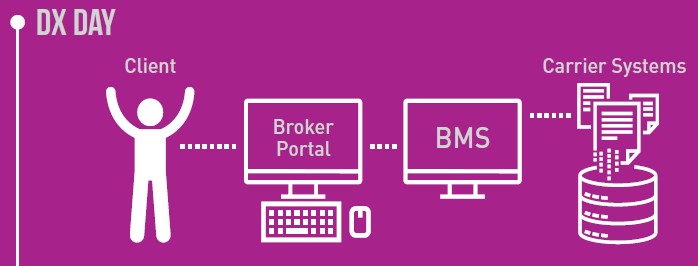

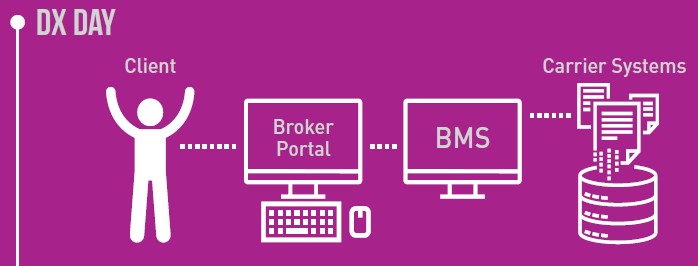

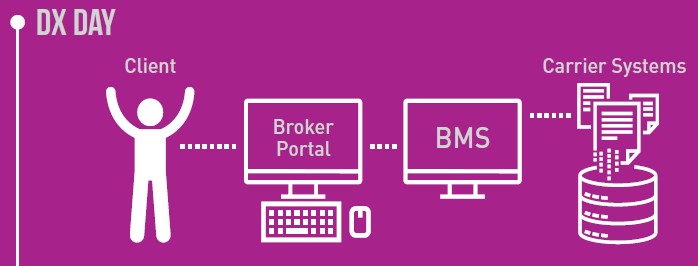

January 2023 In Canada, the Property & Casualty (P&C) insurance industry lags other industries on connectivity within the broker channel. As a result, brokers struggle with process friction and duplication of effort (double entry), resulting in unnecessary expense and a less than ideal client experience. Brokers use their own systems to manage their clients and […]

Insurance Brokers Association of Canada VENDOR JOINT MARKETING DELTEK

January 2023 In Canada, the Property & Casualty (P&C) insurance industry lags other industries on connectivity within the broker channel. As a result, brokers struggle with process friction and duplication of effort (double entry), resulting in unnecessary expense and a less than ideal client experience. Brokers use their own systems to manage their clients and […]

Insurance Brokers Association of Canada IBAC DXCA API BENEFITS WHITEPAPER

January 2023 Executive Summary The broker channel of the P & C insurance industry lags other sectors on connectivity. As a result, the channel struggles with process friction & duplication of effort (double entry), resulting in unnecessary expense and a sub-optimal client experience. IBAC aims to encourage connectivity investment by carriers & broker vendors, as […]