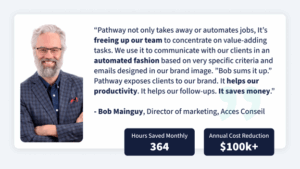

How Acces Conseil Used Insurance Marketing Automation to Cut Workload by 70% and Boost Retention

Acces Conseil used insurance marketing automation to save 364 hours a month, reduce workload by 70%, and improve client retention. Learn how automation helped them scale communications, drive growth, and deliver exceptional service – without adding staff.

For Canadian insurance brokers—especially those who rely on search for awareness, traffic, and lead gen—this presents a big challenge. But also an opportunity to rethink how we show up online.

The Challenge: Managing Growth Without Losing the Personal Touch

Acces Conseil had a solid reputation and a growing customer base. But with growth came complexity. Their team found it increasingly difficult to maintain consistent, personalized communication with their clients while managing policy renewals, claims, and new lead generation.

Traditional methods – manual email campaigns, phone calls, and scattered follow-ups were time-consuming and inefficient. Without a centralized system, important client touchpoints were slipping through the cracks. The leadership knew they needed a solution that could scale with their growth while maintaining their client-first values.

In today’s competitive insurance landscape, brokers need more than a great product – they need smart, scalable tools to help them grow. This is where insurance marketing automation comes in. Acces Conseil, a dynamic brokerage based in Quebec, found their growth catalyst in Pathway’s automation platform.

The Solution: Pathway’s Insurance Marketing Automation Platform

The team at Acces Conseil turned to Pathway, an insurance marketing automation solution specially designed for insurance brokerages. Pathway provided them with tools to automate customer communications, manage renewals, and even generate new business through targeted marketing campaigns.

Key features Acces Conseil implemented:

- eDelivery – sending documents electronically

- Automated Renewal Reminders

- Drip Campaigns

- Client Onboarding Series

- Integrated Surveys and Feedback Requests

- Minimizing Errors and Omissions

- Advanced Segmentation and CRM capabilities

This allowed Acces Conseil to streamline operations, maintain consistency in messaging, and reclaim valuable time for their advisors.

Beyond basic automation, PathwayPort lets brokerages build powerful workflows like e-delivery, welcome emails, onboarding, renewals, drip campaigns, and claims follow-ups. It also supports NPS surveys, lost-client re-engagement, team alerts, and upsell campaigns – all from one platform. These workflows save time, boost loyalty, and ensure consistent client experiences.

The Results: Consistency, Retention, and Revenue

The transformation was immediate. By automating repetitive communication tasks, Acces Conseil saw a significant reduction in manual workloads. Advisors could now focus on higher-value conversations and strategic growth activities.

Key outcomes included:

- Improved Client Retention: Personalized, timely messaging kept clients informed and engaged. Learn more about PathwayPort’s advanced segmentation and integration here.

- Higher Close Rates: Drip campaigns nurtured leads through the sales funnel more effectively.

- Operational Efficiency: Staff saved hours every week that were previously spent on manual outreach.

- Data-Driven Decisions: Campaign performance metrics gave actionable insights into client behaviour.

With automation in place, Acces Conseil was able to confidently scale without compromising on the quality of client interactions.

Real results achieved with insurance marketing automation:

- Achieved a monthly time savings of 364 hours, translating into over $100,000 in annual cost reductions.

- Email open rates soared to 80%, with an impressive 17% conversion rate on automated campaigns.

- Standardized follow-up processes ensured consistent client communication, regardless of the individual broker.

- Renewal-related workloads dropped by 70%, significantly reducing the strain on internal resources and allowing for leaner operations.

Why This Matters for Insurance Brokers

Marketing automation is a strategic advantage for insurance brokers of all sizes. In a competitive market with rising client expectations, automation empowers brokers to do more with less, boosting efficiency, personalization, and growth.

With a platform like PathwayPort, brokers can:

- Stay top-of-mind through consistent, timely communication

- Reduce churn by re-engaging at-risk clients early

- Generate and nurture leads automatically via drip and follow-up campaigns

- Improve onboarding and retention with structured journeys

- Automate tasks like document delivery, birthday greetings, and updates

- Deliver branded, professional emails that enhance the client experience

- Refocus teams on high-value work instead of manual outreach

- Standardize service across the organization

- Leverage real-time insights for smarter decisions

- Scale without increasing staff-maintaining a personal touch at every stage

How insurance marketing automation can help brokers grow lies in its ability to do more with less. It enables businesses to build stronger client relationships while expanding their reach, all without hiring extra staff or sacrificing service quality.

Used by over 300 brokerages across North America, Canada, and the UK, PathwayPort is the #1-rated insurance marketing automation platform for insurance.

Some of the Most Popular Email Marketing Templates Provided by PathwayPort:

The Pre-Renewal Email Workflow automates the delivery of questionnaires, confirms receipt, and sends reminders to non-responders. It alerts brokers if updates are needed, reducing manual work, improving data accuracy, and enabling more personalized, timely policy renewals.

The Billing Reminder automates payment follow-ups by using policy and invoice dates to trigger timely reminders. Messages are tailored to each client’s payment method, helping ensure fast, accurate payments. Brokers benefit from better cash flow and less manual tracking, while clients receive clear, professional guidance-making the payment process smooth and hassle-free.

The Lost Clients Email Workflow is an automated message aimed at re-engaging clients with lapsed or non-renewed policies. It uses a warm, empathetic tone, invites feedback via a brief survey, and encourages reconnection. Brokers gain insights to improve service and recover lost business, while clients are offered a clear, helpful path back.

Want to learn about a workflow that could help improve your brokerage? Schedule a discovery demo today.

Acces Conseil’s Success with Pathway Port

Acces Conseil’s success with PathwayPort shows how insurance-focused automation delivers real results. As the market evolves, brokers who invest in smart tools will be better equipped to manage renewals, nurture leads, and drive growth.

Interested in learning how marketing automation can drive your brokerage’s growth? Visit PathwayPort.com to explore more success stories and schedule a demo.

FAQs

- Can small or mid-sized brokerages use marketing automation effectively?

Yes. Marketing automation platforms like Pathway are built specifically for insurance brokerages of all sizes. Smaller brokerages benefit the most because automation enables them to offer high-touch, personalized service without increasing staff or overhead. - Does Pathway integrate with my existing BMS?

Pathway integrates with leading Broker Management Systems such as Sig, Acturis, Epic, Tam, and Power Broker. It offers two-way data syncing, enabling precise targeting and accurate automated communication. - How does insurance automation improve client retention?

By sending personalized, timely, and consistent messages (e.g., renewal alerts, birthday greetings, claim follow-ups), brokers stay top-of-mind and build stronger client relationships. This leads to higher satisfaction and reduced churn. - What kind of ROI can brokers expect from automation?

Brokers using Pathway typically report:

- 50 – 80% reduction in manual workload

- Over $100,000 in annual operational savings

- Higher lead conversion rates and improved retention

Exact ROI depends on agency size, workflows adopted, and client base.

- How long does it take to implement Pathway’s automation system?

Most brokerages can be fully set up within 10-12 weeksPathway offers onboarding support, workflow templates, and advanced integration with existing systems to ensure a smooth transition. - Can I customize email templates and workflows?

Absolutely. Pathway offers a rich library of different email templates and articles that you can personalize using client data from your BMS. You can also build custom workflows using conditional logic, segmentation, and behavioural triggers.

Article written by Pathway

https://www.pathwayport.com/