January 2023

In Canada, the Property & Casualty (P&C) insurance industry lags other industries on connectivity within the broker channel. As a result, brokers struggle with process friction and duplication of effort (double entry), resulting in unnecessary expense and a less than ideal client experience.

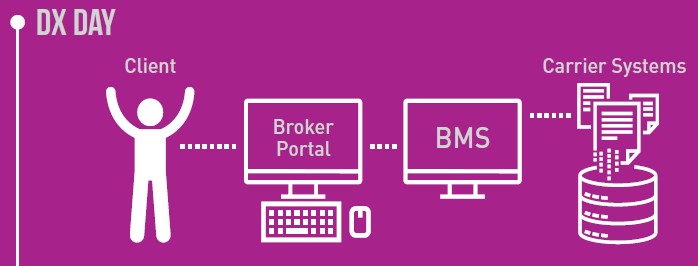

Brokers use their own systems to manage their clients and carriers use theirs. Initial data entry is done by the broker into their BMS and then re-keyed (by the broker) into the carrier portal.

This approach requires double entry by the broker and introduces delays and data quality issues, which in turn require manual intervention and negatively impacts the end client experience.

While most other industries have made great headway in real-time data sharing and transmission along the steps in the value chain, real-time data connectivity remains in its infancy in the P&C industry.

However, there is progress being made. CSSI has recently introduced some exciting newfeatures, including:

- Gore Mutual Direct Rating

- CSSI recently completed auto and habitational rating for Ontario and British Columbia. Accurate pricing enhances the client’s buying experience and reduces the broker’s time & cost to serve the client.

-

- SGI CANADA Realtime Policy Change Improvements

CSSI has been working with brokers to refine realtime policy change, to allow brokers to serve clients more quickly.

- TBW Cloud

- CSSI is building TBW Cloud, a next-generation cloud quoter and broker management system (BMS) architected for API integration. This will position TBW

to be among the leaders in carrier integration.

- CSSI is building TBW Cloud, a next-generation cloud quoter and broker management system (BMS) architected for API integration. This will position TBW

- Wawanesa New Business

- CSSI and Wawanesa are working together to deliver policy documents in realtime directly into TBW, reducing client wait times.

- CSSI IntelliQuote SaaS

- CSSI is in the process of migrating IntelliQuote to a SaaS platform for TBW Cloud and other broker management systems, increasing it’s reach and

availability.

- CSSI is in the process of migrating IntelliQuote to a SaaS platform for TBW Cloud and other broker management systems, increasing it’s reach and

To further understand real-time adoption behaviour, CSSI has created two working groups with brokerages and their power users. In weekly sessions, they interview these brokers to get their feedback on what is working with the current BMS/Carrier realtime integration and where challenges still exist. CSSI discovered further evidence supporting the need for carriers to offer the same functionality in realtime as they do today in their portals. If BMS realtime is only allowed to support a fraction of what a portal does (even upwards of 95%), brokers continue to be forced down the path of full functionality, which today is still the carrier portal. Without the carriers offering full portal parity in BMS realtime, we will continue to see heavy usage of carrier portals in our industry.

It is likely, however, that realtime connectivity will not arrive in the broker channel all at once – the progress will be incremental. We encourage brokers to discover the enhancements that their vendor partners have already implemented and to make use of them.

We also encourage carriers and vendors to continue to make investments in real-time connectivity. Given that there are benefits to customers, brokers, and carriers, it only makes sense to push this as hard and fast as possible.