January 2023

In Canada, the Property & Casualty (P&C) insurance industry lags other industries on connectivity within the broker channel. As a result, brokers struggle with process friction and duplication of effort (double entry), resulting in unnecessary expense and a less than ideal client experience.

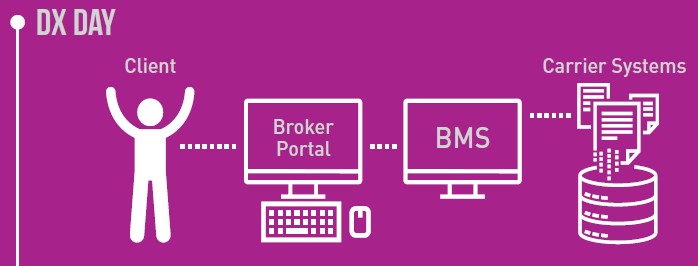

Brokers use their own systems to manage their clients and carriers use theirs. Initial data entry is done by the broker into their BMS and then re-keyed (by the broker) into the carrier portal.

This approach requires double entry by the broker and introduces delays and data quality issues, which in turn require manual intervention and negatively impacts the end client experience.

While most other industries have made great headway in real-time data sharing and transmission along the steps in the value chain, real-time data connectivity remains in its infancy in the P&C industry.

However, there is progress being made. Applied Systems has recently introduced some exciting new features, including:

-

- Small commercial rating integration with a growing panel of insurers, including Northbridge & Wawanesa. Accurate, real-time quotes eliminate double entry & rework, allowing brokers to serve more clients with less friction.

- Greater than 70% of quoted personal lines premium volume through Applied Rating Services (ARS) is generated via API connectivity directly connected to carrier rating systems. Rates generated in this fashion are always accurate & up to date. This reduces friction and rework for the broker & improves the experience for the customer.

- Applied Data Lake technology delivers simpler access to a more comprehensive set of data – your own and third party – to enable you to collect and organize it into insights using existing business intelligence (BI) tools. The Applied Data Lake provides easier

access to data so brokers can create custom reports and analyze & act on information more quickly. - Integrating eDocs-based claims & billing notifications into Epic so that front-line brokers do not have to access carrier portals to stay on top of relevant client information. This saves time for the broker & improves the client experience.

Real-time connectivity will not arrive in the broker channel all at once – the progress will be incremental. We encourage brokers to discover the enhancements that their vendor partners have already implemented and to make use of them.

We also encourage carriers and vendors to continue to make investments in real-time connectivity. Given that there are benefits to customers, brokers, and carriers, it only makes sense to push this as hard and fast as possible.