IBAC AI Working Group

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

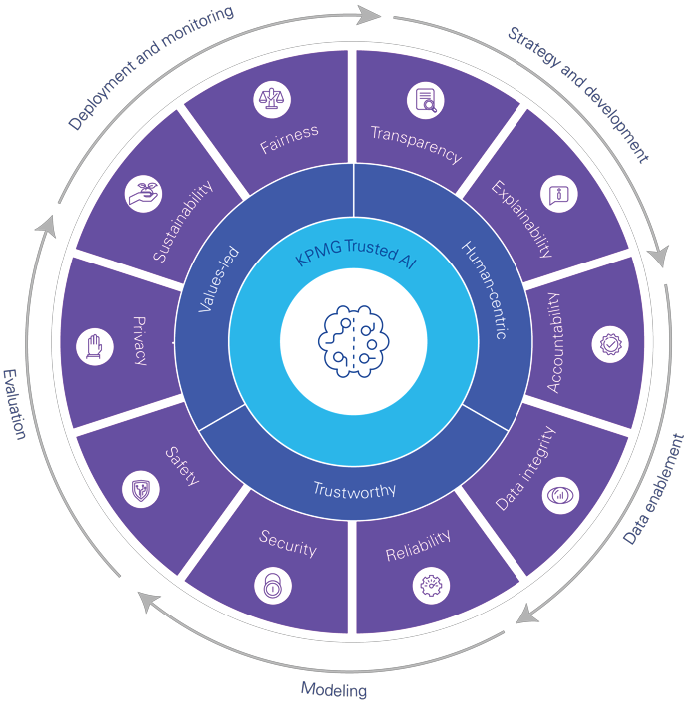

AI solutions should be designed to reduce or eliminate bias against individual, communities, and groups.

AI Solutions should be designed to comply with applicable privacy and data protection laws and regulations.

Robust and resilient practices should be implemented to safeguard AI solutions against bad actors, misinformation, or adverse events.

AI solution should be developed and delivered in a way that answers the questions of how and why a conclusion was drawn from the solution.

Data used in AI solutions should be acquired in compliance with applicable laws and regulators and assessed for accuracy, completeness, appropriateness, and quality to drive trusted decisions.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

AI solutions should be designed to be energy efficient, reduce carbon emissions, and support a cleaner envoirment.

AI solution should be designed and implemented to safeguard against harm to people, businesses, and property.

AI solution should include responsible disclosure to provide stakeholders with a clear understanding of what is happening in each solution across the AI lifecycle.

Human oversight and responsibility should be embedded across the AI lifecycle to manage risk and comply with application laws and and regulations.

AI solutions are designed and implemented with robust and resilient practices that safeguard against threats, bad actors, misinformation, and adverse events, ensure safety for all stakeholders, and consistently operate at desired precision levels.

AI solutions and the data used are designed and acquired to comply with applicable laws and regulations and assessed for accuracy completeness, appropriateness and quality to drive trusted decisions

Responsible disclosure and design that answers the questions of how and why a conclusion was drawn from an AI Solution, ensuring stakeholders understand what is happening in the AI lifecycle

AI solutions ensure unbiased decision-making to foster trust and collaboration among brokers, regulators, industry groups, technology providers and member associations

AI solutions contribute to the value of ensuring a vibrant and long-term future for the broker distribution channel

AI solutions ensure human oversight and responsibitly to be answerable to customers to safeguarding their interests, managing risks and ensure compliance with applicable laws and regulations

Optimize workflows with AI solutions to improve claims processing and underwritng, while tailoring solutions through predictive analytics. Ensure human oversight is preserved for handling complex cases

Get practical insights on responsible AI adoption, risk management, and compliance in one concise guide.

AI models with context on industry benchmarks and policy structures to interpret existing policy terms, endorsements, and clauses.

Integration with BMS to retrieve client profiles, exposure information, and historical policy data.

Data ingestion and continuous updates to ensure alignment with typical coverage patterns and industry guidance.

Data security and compliance features to protect client information.

Analyze client-submitted data, including exposures, business context, and other relevant information.

Extract and interpret existing policy terms (e.g., endorsements, exclusions, clauses).

Benchmark against typical coverage patterns and industry guidance to identify coverage gaps.

Prioritize identified coverage gaps and provide rationale based on considerations such as industry standards and risk.

Recommend relevant products and coverage options tailored to the client profile, and generate summaries for client discussions.

BMS Integration: Integration with BMS for secure data capture and storage.

Applied ARS Integration: Integration with Applied ARS to enable automated quote generation.

Dedicated Parsers for Renewal: Document parsing capability for 5–6 carrier renewal documents with high accuracy.

Extensibility Framework: Modular architecture to support future enhancements and additional automation.

AI Chatbot for Client Onboarding: Collect client information, answer onboarding questions, and guide users through the onboarding process.

Data Collection & Storage: Capture and store collected data directly in the broker’s BMS.

Document Processing: Enable clients to upload renewal documents and extract key data to accelerate the onboarding process.

Quotes Generation: Generate quotes based on collected information.