January 2023

In Canada, the Property & Casualty (P&C) insurance industry lags other industries on connectivity within the broker channel. As a result, brokers struggle with process friction and duplication of effort (double entry), resulting in unnecessary expense and a less than ideal client experience.

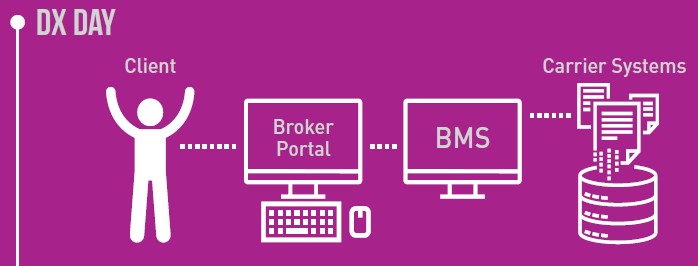

Brokers use their own systems to manage their clients and carriers use theirs. Initial data entry is done by the broker into their BMS and then re-keyed (by the broker) into the carrier portal.

This approach requires double entry by the broker and introduces delays and data quality issues, which in turn require manual intervention and negatively impacts the end client experience.

While most other industries have made great headway in real-time data sharing and transmission along the steps in the value chain, real-time data connectivity remains in its infancy in the P&C industry.

However, there is progress being made. BrokerLift has recently introduced some exciting new features, including:

- Becoming a Vertafore “Orange” Partner with a real-time API connection to SIG

- Insurance sales completed by self-directed clients on the Broker’s website, or by Brokers on their custom portal, flow seamlessly into SIG. As most transactions are paid by credit card, the only remaining step is for the accounting team to clear the receivable. No further data entry is required.

- Completed custom integrations with Applied’s EPIC that create & upload a client record generated from a client serve self web transaction

- For either a short form or custom/long form products, the BrokerLift platform can send data to EPIC in real time. This is very useful for custom product and commercial programs that bind and renew online by clients on the Broker’s or Association’s website.

• Real-time rating & bind API for tenant policies with Wawanesa, including immediate upload to Wawanesa’s underwriting system & EDI download back to the BMS

o As this is 100% client self serve, it frees up CSRs to handle more complex duties

• Integration with Hubspot CRM

o BrokerLift supports nearly 2 dozen Personal & Commercial “Marketplace” products. As few client self-serve sales are “once and done”, the direct integration to Hubspot enables the Brokerage to trigger marketing automation workflow and track their follow-up activities to ensure a higher close rate & higher sales volume

BrokerLift’s core platform features enable full white-label eCommerce capabilities for Brokers; allowing them to embed real-time Quote, Bind, Pay, Issue products into their web site (or partner sites – eg. affiliate programs). The Broker can leverage a number of

pre-built “Marketplace” products or use BrokerLift as a Policy Administration System to build and deploy their custom products / programs.

The insured is able to buy or renew their policy 24/7 and with API integration the broker is able to see the completed transaction in their BMS – where they expect it – without the need to key data. This saves time for the broker and allows the client to enter/review data whenever and wherever their schedule permits.

A new feature of the platform allows multiple parties within an insurance transaction to engage simultaneously. This is especially useful for specialty insurance, programs, bonds etc, where there are potentially 4 parties that need to be involved in a transaction.

The fluidity of this process keeps the application process moving fast, everyone sees the same data and removes friction from the process.

Real-time connectivity will not arrive in the broker channel all at once – the progress will be incremental. We encourage brokers to discover the enhancements that their vendor partners have already implemented and to make use of them. We also encourage

carriers and vendors to continue to make investments in real-time connectivity. Given that there are benefits to customers, brokers, and carriers, it only makes sense to push this as hard and fast as possible.