January 2023

Executive Summary

The broker channel of the P & C insurance industry lags other sectors on connectivity. As a result, the channel struggles with process friction & duplication of effort (double entry), resulting in unnecessary expense and a sub-optimal client experience. IBAC aims to encourage connectivity investment by carriers & broker vendors, as well as broker adoption, by measuring certain important benefits of a truly connected broker channel.

IBAC undertook a process analysis project to investigate a few of the CSIO Innotech 2022 top 10 API priorities. This project focussed on three of that top 10 list – PL Quote, PL policy change and billing amendment. The project team measured & quantified the benefit by examining live broker transactions over a three week period, with a diverse set of broker participants.

Key findings include:

- Quote APIs create tangible expense saving & customer experience benefits

- Policy change APIs create tangible expense saving & customer experience benefits

- Use of Quote APIs create significant financial & competitive data analysis benefit for carriers

- A portion of both the quote & policy change transaction could be presented to customers in the form of self serve options

Removing the hurdle of process friction and double entry expenses levels the playing field with the direct writers. That, combined with the broker channel’s strengths of choice and advocacy, will clearly make the broker channel the best choice for consumers and allow brokers to retake market share.

BACKGROUND

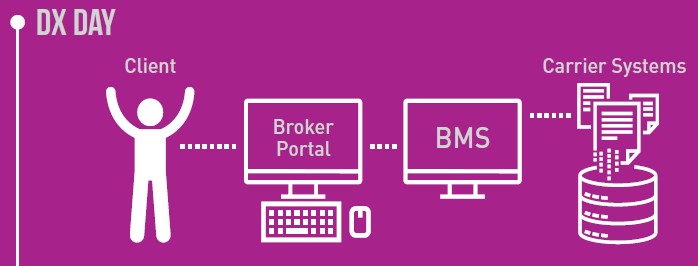

Brokers use their own systems to manage their clients and carriers use theirs. Initial data entry is done by the broker and then re-keyed (by the broker) into the carrier portal. Subsequently, occasional updates are made by carrier staff and/or systems and downloaded back to the broker system. This approach requires double entry by the broker and introduces data quality issues that pervade the industry, requiring costly manual intervention & negatively impacting the end client experience. While most other industries have made great headway in realtime data sharing / transmission among the steps in the value chain, realtime data transmission remains in its infancy in the P & C industry.

METHODOLOGY AND FOCUS

The project team was comprised of process engineers from Online Business Systems (OBS), volunteers from 3 geographically diverse brokers, senior representatives from 2 major carriers and was conducted under the management of Tom Reid & the IBAC Tech Committee.

The IBAC Tech Committee determined the focus of the analysis was to be:

- PL Quote

- PL policy change

- Billing amendment

These three transactions were chosen for the potential broker benefit as well as their inclusion on the 2022 CSIO Innotech priority list. The working team identified the various steps in each transaction process as well as the steps that would be taken out (or slimmed down) with the implementation of the relevant

APIs. Live client data was then captured over a three week period and tracked, based on the process flow. Once the data had been captured, the OBS team analyzed the data to determine the “before & after” benefits of API implementation on those transactions. Note that billing amendment was not analyzed as the minimum threshold for transaction count was not met during the project window.

The workflow charts above are representative of the reduced friction due to broker/carrier connectivity.

The workflow charts above are representative of the reduced friction due to broker/carrier connectivity.

BROKER BENEFITS

Target broker benefits included a reduction in broker effort (touch time), the start to end duration (cycle time) of a client’s request as well as the number of transactions that could have been transferred to the client as self serve.

The following broker benefits were measured:

PL Quote

- Significantly increase accuracy of quoting. The study showed that slightly more than 1/3 of quotes provided were more than 2% different than the premium calculated through the carrier portal.

- Reduction in double entry & incorrect quote follow up saves 11-17% of the effort to provide a quote.

- Improvement in client experience by shortening the duration of providing a quote by up to half in PL Auto

- Improvement in client experience by providing correct rates at the point of sale

PL policy change

- Performing policy change in the broker’s native system will reduce the effort for this transaction between 40-55%

- The duration of a policy change can be reduced by between 40-50% Client Self Serve

- Up to 1/3 of the effort & duration of the measured transactions could have been provided to the client as self serve opportunities, further reducing the broker effort and increasing the level of the client experience.

Client Self Serve

- Up to 1/3 of the effort & duration of the measured transactions could have been provided to the client as self serve opportunities, further reducing the broker effort and

increasing the level of the client experience.

CARRIER BENEFITS

Carrier benefits were identified through a series of independent interviews with executives from two carriers who have both implemented new policy admin systems that include a focus on connectivity.

Benefits uncovered include redeployment of UW staff, improved time to market for rating changes, access to data on all quotes – not just bound policies – and increased staff and broker experience.

Carrier benefits rated as high impact by both carriers include:

- Access to data on quoted but not bound policies, allowing accurate assessment of competitive positioning and product offerings down to a granular level.

- Improves speed to market for rate changes by 6-8 weeks, improving both competitive positioning and loss ratio

- Reduced error correction & broker follow ups allow for redeployment of UWs into higher value roles or a reduction in expenses

TAKEAWAY

Connectivity between carriers & brokers has always been understood to be a good thing and a valuable goal for the industry. To date, that understanding has not been adequate to drive enough investment by carriers & vendors. It has also not been enough to drive mass broker adoption of those real time transactions that have been implemented and are currently available.

Real time connectivity will not arrive in the broker channel all at once – this is an incremental battle that will last for some time. We encourage brokers to discover the transactions that their vendor/carrier partners have already implemented and to make use of them. We also encourage carriers & vendors to continue to make investments in real time connectivity. Given that there are benefits to customers, brokers and carriers, it makes sense to push this as hard and fast as possible.